🌊 Credit,

not pools.

Structured credit for tokenized assets. Create your loan book. Match borrowers and lenders directly. Fixed rates, maturities, repayment terms. No socialized risk pools. For you and your Agent. Live on Base.

🔥 Pool Lending is Broken

One rate curve for all borrowers. One bad position and everyone pays. Variable rates swing 100%+. That's not credit. It's a shared risk bucket.

See What Pools Are Costing You

Based on observed lending spreads.

🏗️ The Spread Pools Take from You

🏗️ The Spread Pools Take from You

Borrower pays: 12.8%

Lender earns: 3.6%

9.2% LOST TO POOL

Floe matched rate: 7.4%

Same collateral. Same borrower risk.

Different architecture.

⚡ The loan order book onchain.

We eliminated the pool. Floe matches borrowers and lenders directly.

⚡ The loan order book onchain.

We eliminated the pool. Floe matches borrowers and lenders directly.

1

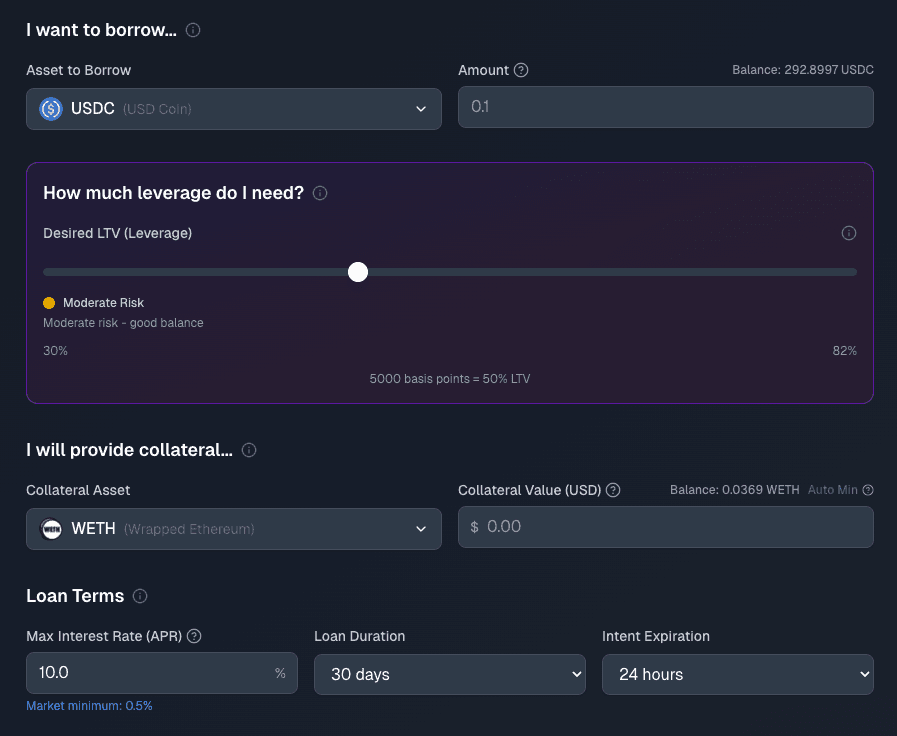

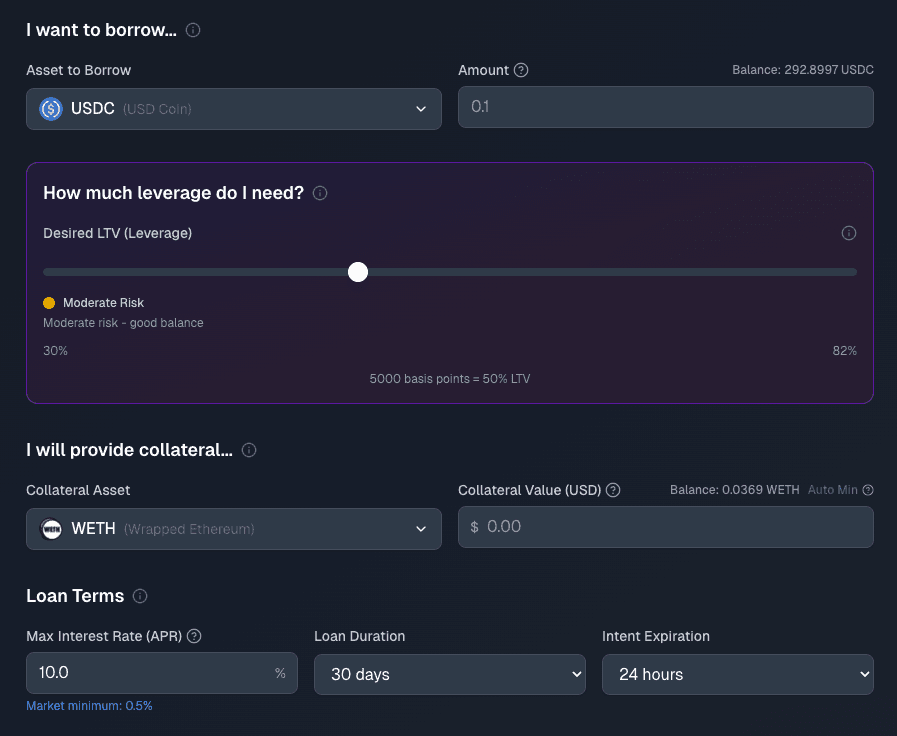

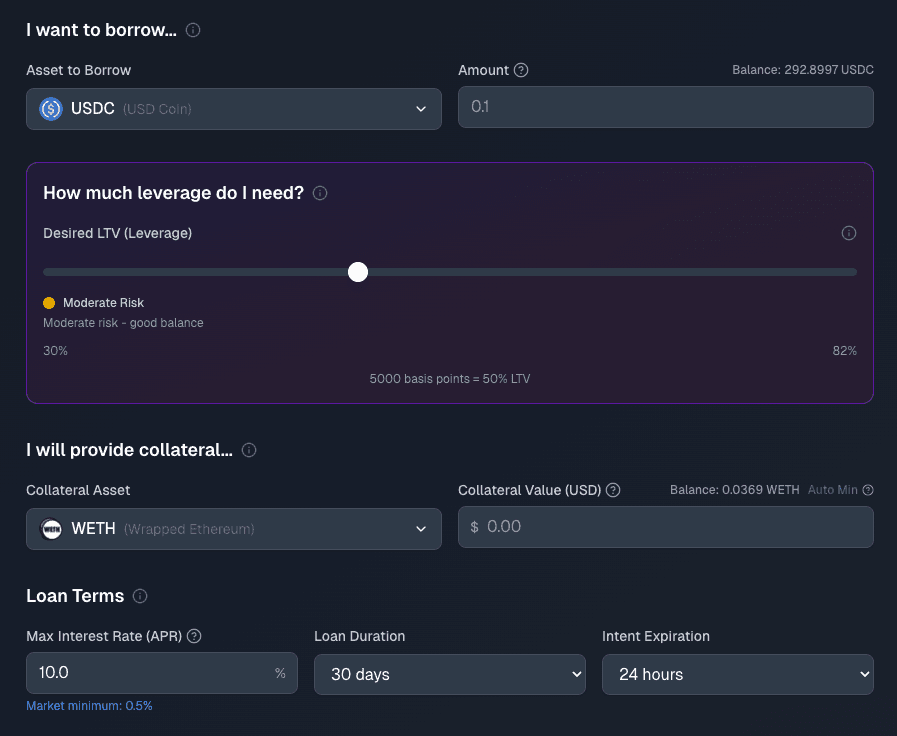

Create Your Loan Book. Or Borrow Order.

Specify what you want: asset, rate, term, collateral. Or just tell Lendr in plain english.

1

Create Your Loan Book. Or Borrow Order.

Specify what you want: asset, rate, term, collateral. Or just tell Lendr in plain english.

1

Create Your Loan Book. Or Borrow Order.

Specify what you want: asset, rate, term, collateral. Or just tell Lendr in plain english.

2

Match

Browse existing intents and match manually. Or bots algorithmically match compatible intents. Your choice.

2

Match

Browse existing intents and match manually. Or bots algorithmically match compatible intents. Your choice.

2

Match

Browse existing intents and match manually. Or bots algorithmically match compatible intents. Your choice.

3

Loan executes, protected positions.

Smart contract escrows collateral and executes loan. Fixed rates, fixed terms. Programmatic margin calls protect lenders.

3

Loan executes, protected positions.

Smart contract escrows collateral and executes loan. Fixed rates, fixed terms. Programmatic margin calls protect lenders.

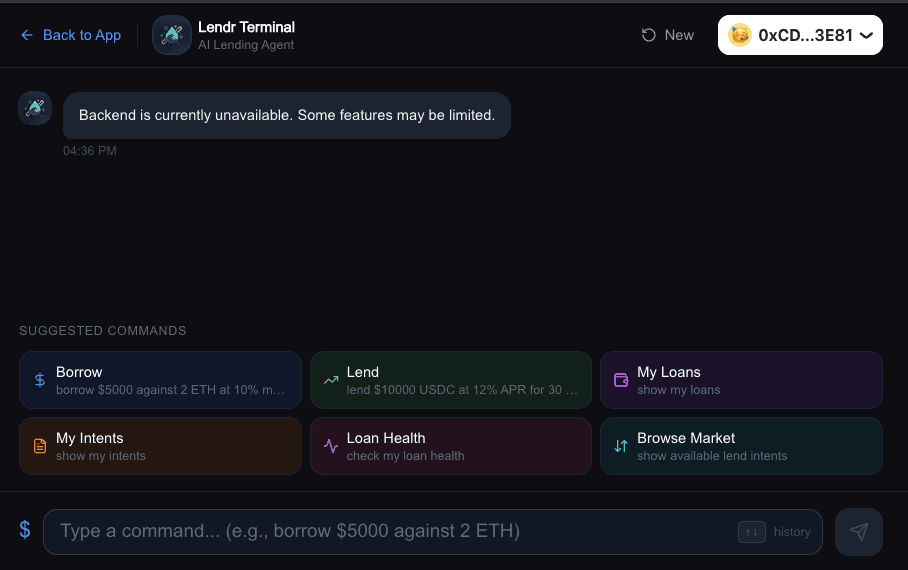

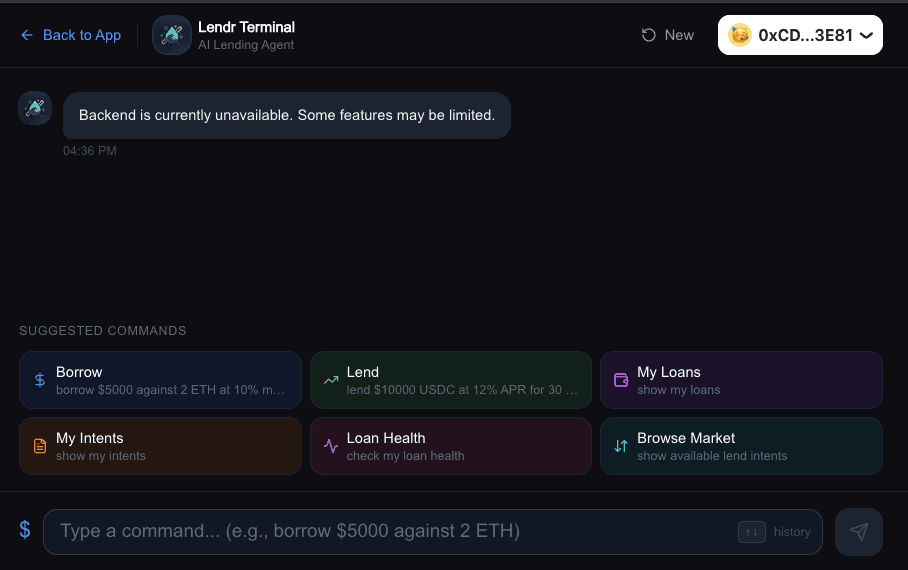

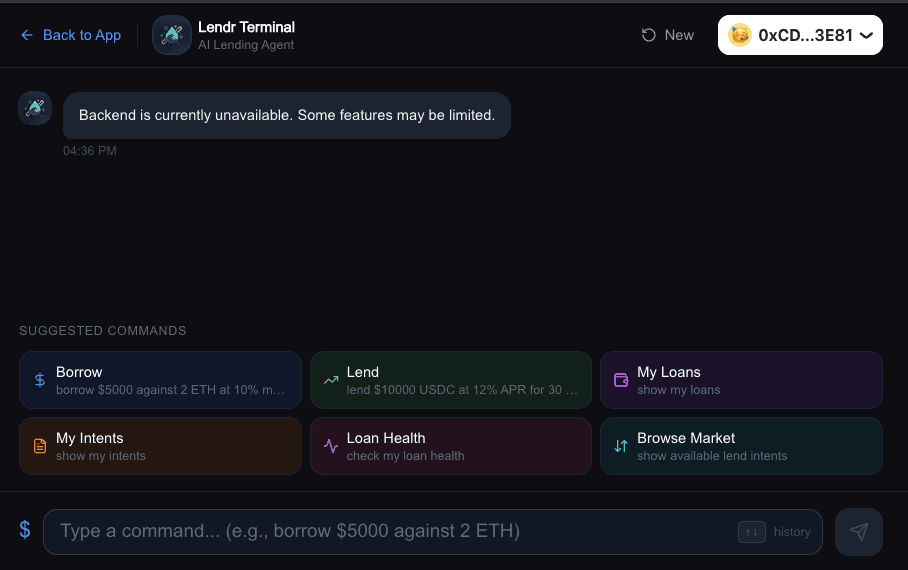

🤖 Meet Lendr, the First Credit Agent

🤖 Meet Lendr, the First Credit Agent

1

Plain English --> Credit

Just say what you need in plain english. Lendr handles intent creation, matching and execution.

1

Plain English --> Credit

Just say what you need in plain english. Lendr handles intent creation, matching and execution.

1

Plain English --> Credit

Just say what you need in plain english. Lendr handles intent creation, matching and execution.

2

Every Channel is a Credit Channel

Every interaction on X, Telegram, Base App or Farcaster.

2

Every Channel is a Credit Channel

Every interaction on X, Telegram, Base App or Farcaster.

2

Every Channel is a Credit Channel

Every interaction on X, Telegram, Base App or Farcaster.

3

Credit for AI Agents

Floe supports AI agents from using Openfort, Coinbse Agentkit and others to make Floe the credit layer for the agent economy.

3

Credit for AI Agents

Floe supports AI agents from using Openfort, Coinbse Agentkit and others to make Floe the credit layer for the agent economy.

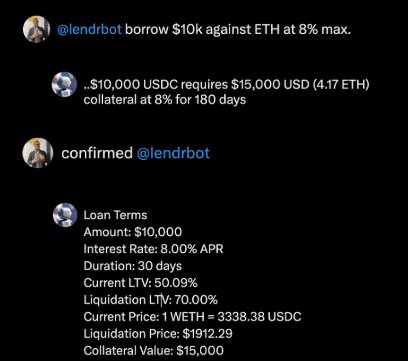

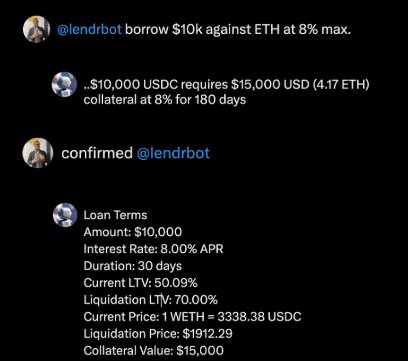

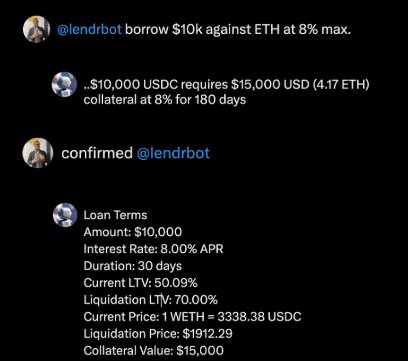

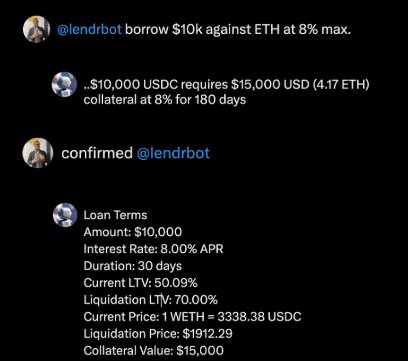

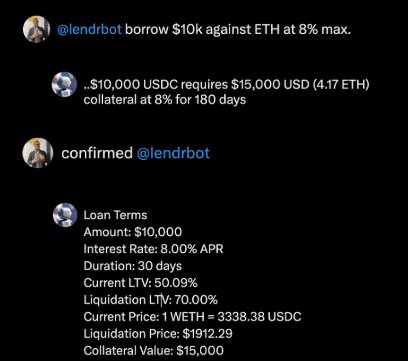

1

The first AI agent that executes DeFi lending via natural language.

@LendrBot borrow $10k against WETH at 9% max.

1

The first AI agent that executes DeFi lending via natural language.

@LendrBot borrow $10k against WETH at 9% max.

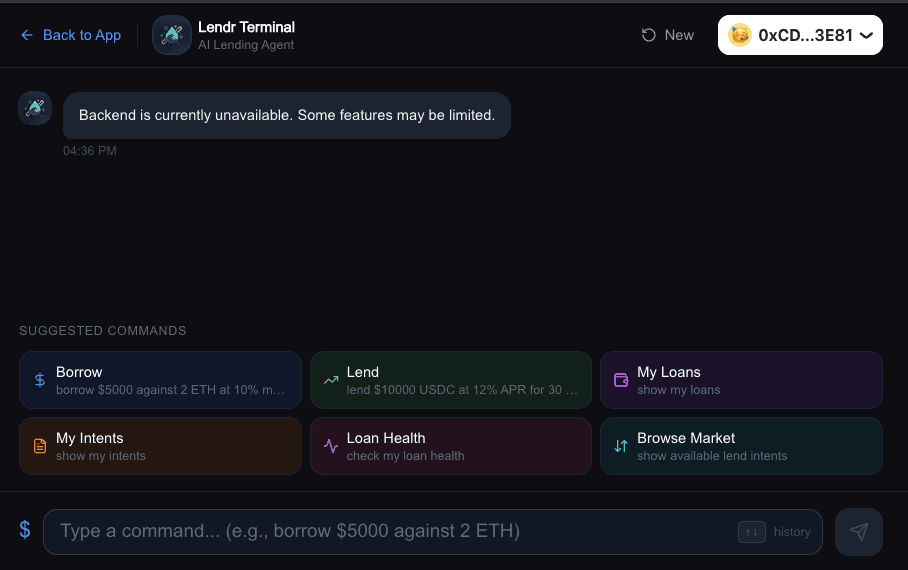

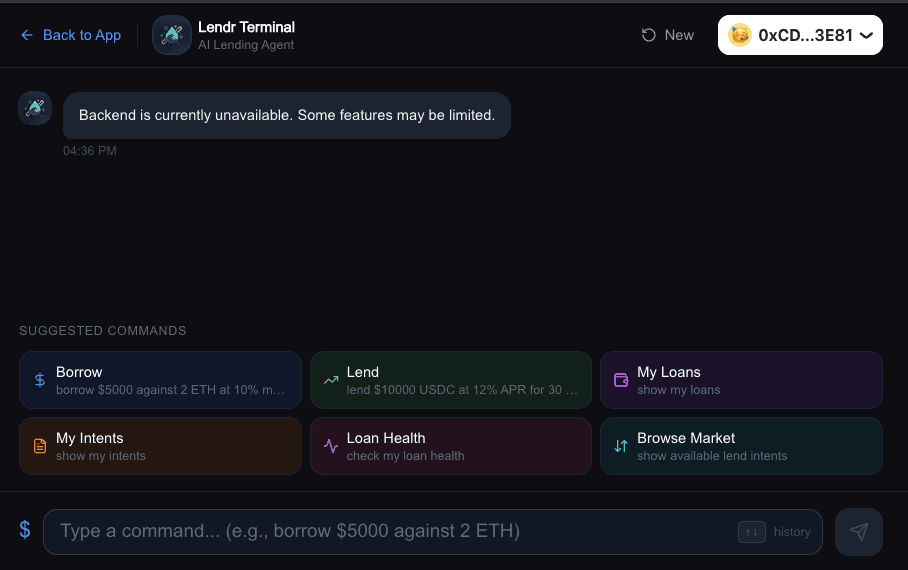

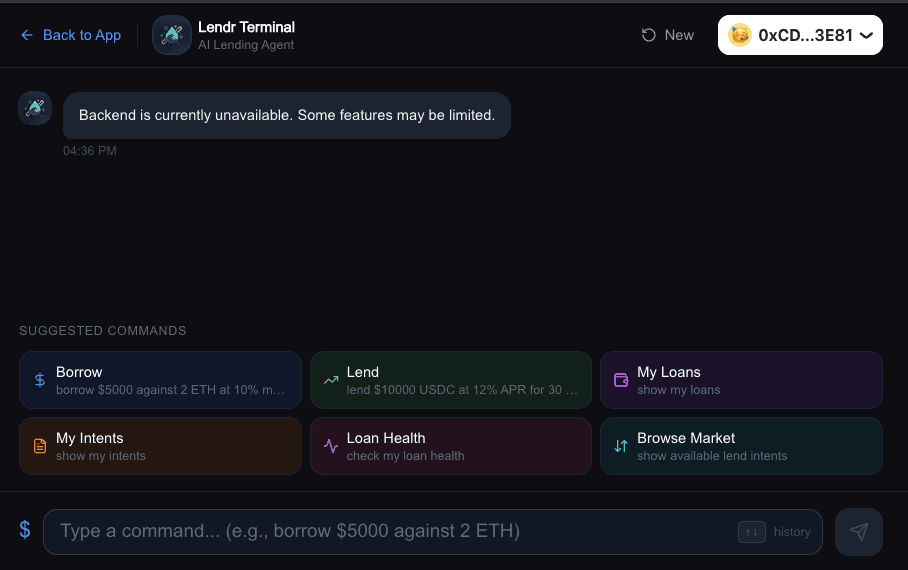

2

In App • Telegram • X Alerts

Chat in-app, DM @LendrBot on Telegram, or ge real time arb alerts on X.

2

In App • Telegram • X Alerts

Chat in-app, DM @LendrBot on Telegram, or ge real time arb alerts on X.

3

X Notifications

Get real-time alerts on earn or borrow opportunities and matches delivered straight to X. Follow @LendrBot.

3

X Notifications

Get real-time alerts on earn or borrow opportunities and matches delivered straight to X. Follow @LendrBot.

X NOTIFICATIONS

Real-time alerts on opportunities, arbs, and matches. Follow in x.com/LendrBot

X NOTIFICATIONS

Real-time alerts on opportunities, arbs, and matches. Follow in x.com/LendrBot

TELEGRAM BOT

DM to borrow/lend instantly. t.me/LendrBot e.g. Borrow $15K USDC using my Bitcoin

TELEGRAM BOT

DM to borrow/lend instantly. t.me/LendrBot e.g. Borrow $15K USDC using my Bitcoin

TELEGRAM BOT

DM to borrow/lend instantly. t.me/LendrBot e.g. Borrow $15K USDC using my Bitcoin

💎 For Borrowers

Tell LendrBot What You Need

"Borrow $50k against my AAPL shares at 8% APR max."

Tell LendrBot What You Need

"Borrow $50k against my AAPL shares at 8% APR max."

Lendr Creates Your Intent

Translates your request onchain actions with your exact terms. You sign securely.

Lendr Creates Your Intent

Translates your request onchain actions with your exact terms. You sign securely.

Lendr Creates Your Intent

Translates your request onchain actions with your exact terms. You sign securely.

Get Matched P2P

Connected directly with lenders, no pool dilution, keep your upside

Get Matched P2P

Connected directly with lenders, no pool dilution, keep your upside

🌊 For Lenders

Create Loan Book

Define maturity, repayment terms, rates, collateral types, and risk parameters.

Create Loan Book

Define maturity, repayment terms, rates, collateral types, and risk parameters.

AI Optimized Matching

AI Agent translates your request into an onchain intent with your exact terms. You sign securely.

AI Optimized Matching

AI Agent translates your request into an onchain intent with your exact terms. You sign securely.

AI Optimized Matching

AI Agent translates your request into an onchain intent with your exact terms. You sign securely.

Earn Predictable Yield

Fixed rates, transparent terms, institutional-grade collateral.

Earn Predictable Yield

Fixed rates, transparent terms, institutional-grade collateral.

🏗️ Beyond Lending: The Hook Architecture

🏗️ Beyond Lending: The Hook Architecture

Floe isn't a lending protocol. It's a coordination layer.

Every credit position is a surface what services attach to.

Liquidation & Matching | Third-party bots

Oracles | Chainlink, Pyth

Compliance | KYC/AML op-in

Vaults | Yield aggregators

Ramps | Fiat rails

Notifications | Telegram Bot, X Alerts

🌊 Built for Three Audiences.

Institutions

Create and manage a loan book on Floe. Fixed rates, maturity, repayment terms, isolated counterparty risk. Permissionless base layer with permissioned options for regulated entities.

Institutions

Create and manage a loan book on Floe. Fixed rates, maturity, repayment terms, isolated counterparty risk. Permissionless base layer with permissioned options for regulated entities.

Institutions

Create and manage a loan book on Floe. Fixed rates, maturity, repayment terms, isolated counterparty risk. Permissionless base layer with permissioned options for regulated entities.

DeFi Mullet Natives

Set your own rates. Pick your risk. No more subsidizing bad debt in a shared pool. On Floe, every position is bilateral and isolated. You choose your collateral, your counterparty, your terms. If your borrower defaults, that's your position — not a pool-wide event.

DeFi Mullet Natives

Set your own rates. Pick your risk. No more subsidizing bad debt in a shared pool. On Floe, every position is bilateral and isolated. You choose your collateral, your counterparty, your terms. If your borrower defaults, that's your position — not a pool-wide event.

Investors

First mover in bilateral DeFi credit. Trading evolved from AMMs to order books. Lending is next. Floe is the first credit DEX — direct matching with fixed terms and isolated risk. Live on Base mainnet.

Investors

First mover in bilateral DeFi credit. Trading evolved from AMMs to order books. Lending is next. Floe is the first credit DEX — direct matching with fixed terms and isolated risk. Live on Base mainnet.

Investors

First mover in bilateral DeFi credit. Trading evolved from AMMs to order books. Lending is next. Floe is the first credit DEX — direct matching with fixed terms and isolated risk. Live on Base mainnet.

🛡️ Security

🛡️ Security

Audited by Omniscia

Read Report (pdf)

💰 Liquidity Partners

💰 Liquidity Partners

Seed loan books.

3-12 month terms

10+% target APY

Dedicated support

Seed loan books.

3-12 month terms

10+% target APY

Dedicated support

Your Questions, Answered

Your Questions, Answered

Find everything you need to know about Floe and LendrBot.

Find everything you need to know about Floe and LendrBot.

What makes Floe different from Aave or Morpho?

Is Floe audited?

What is Lendr?

What collateral types are supported?

What makes Floe different from Aave or Morpho?

Is Floe audited?

What is Lendr?

What collateral types are supported?

How does Floe make money?

What is the Telegram bot?

What are X notifications?

How can I contact support?

How does Floe make money?

What is the Telegram bot?

What are X notifications?

How can I contact support?

Ready to ditch the pool?

Credit that works like credit.